Searching for an interest rate which have a low advance payment? Discover how a traditional 97 Financing could help you get into your new home.

You have got read that in the event that you are interested a household, you desire good 20% down-payment. You can even concern you to definitely in the place of this lump sum payment, there’s no way it is possible to rating a house during the a competitive homebuying industry. Avoid being annoyed; there are many more an effective way to help make your dream of are an effective resident an actuality.

With respect to the Fannie mae, called Fannie mae, the greatest issue to own very first-day homebuyers was rescuing enough currency with the advance payment. There can be yet another particular mortgage built to help defeat so it test: the standard 97 Financing, or as Federal national mortgage association calls it, the quality 97 Percent Financing-to-Well worth Home loan. Come across note step 1

What’s a normal 97 Loan?

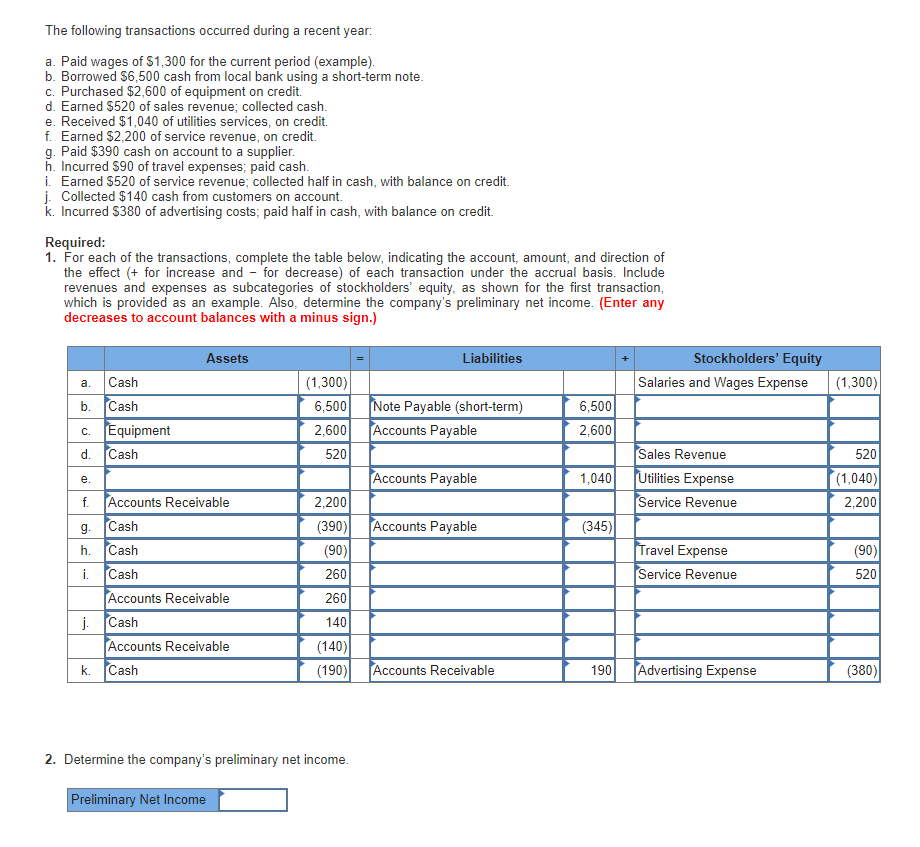

It’s one of the low of your own lowest-down-commission home loan possibilities. As with all finance, this new terms and conditions and needs vary by-product and you can lender. Below are a few of your maxims about any of it loan:

- People place 3% down and finance one other 97% of the mortgage – and this the name.

- It’s a fixed-rates home mortgage. The fresh new monthly payment remains the same during the fresh new mortgage.

- Individual home loan insurance coverage, otherwise PMI, required up until 80% of your own totally new value of the house is actually paid.

- It is geared toward basic-big date homebuyers in almost any money bracket.

Having experienced a primary-day homebuyer?

Once you tune in to the word “first-date homebuyer,” you can even visualize an earlier-career professional or at least a newly hitched couple. Although operating meaning is significantly bigger with regards to a traditional 97 Mortgage.

- A minumum of one debtor try an initial-day homebuyer, or

- One borrower hasn’t possessed a home to own on the very least 3 years early in the day.

Consider this to be scenario. A person purchased property a decade in the past and you can marketed they after 5 years. It spent the very last 5 years leasing a flat. This individual could well be noticed an initial-big date homebuyer once again.

Included in this owns a residence. One other borrower cannot very own assets, and you will have not owned one for at least three years. Which few you may however qualify since first-day homeowners. Get hold of your financial for further info and needs or even speak about your unique state.

Qualifications to have a traditional 97 Mortgage

- Loan wide variety. Lowest and you may restriction loan numbers ount most useful suits your needs.

- Lowest credit history. Government-sponsored businesses, including Fannie mae, want a credit rating away from 620 or even more. Particular loan providers might require a top credit history. Contact your financial more resources for their program and requirements.

- Debt-to-income ratio. Lenders evaluate your own monthly obligations towards gross month-to-month money. They want to observe most of your earnings has already been used on bills such automobile otherwise mastercard repayments. This will be you to definitely measure of your ability to complete the latest month-to-month money toward loan amount you intend in order to acquire.

At this point, you know the basic keeps along with a concept of the necessary standards to qualify for one to. Now consider how this information means benefits and drawbacks.

The regular 97 financing helps you transfer to the domestic smaller. The lower 3% down payment setting you may spend a shorter time saving upwards before you could can acquire.

Pro: Fulfill other discounts specifications.

You to low down fee along with allows you to to construct significantly more discounts some other spends such as for instance swinging expenses. You might start a family savings to possess upcoming home renovations. Otherwise, for people who have not done this currently, you could start an urgent situation loans.

Pro: Brand new qualification tends to be a far greater match.

What’s needed to have a normal 97 mortgage tends to be reduced constraining versus other kinds of mortgages. Eg, discover occupancy due dates and constraints regarding the condition of our home to possess an experts Administration mortgage.

Con: Monthly premiums can be high.

The conventional 97 mortgage necessitates that you have to pay Individual Financial Insurance, otherwise PMI, up until 80% of the original family well worth is actually paid. PMI premiums are added to your own month-to-month mortgage payment. This can end up in increased total monthly payment than simply if you have made a larger downpayment. Your We upwards-front side during the time of closing for the financing. Ask your financial concerning your solutions.

The typical 97 Financing does effortlessly lose that significant obstacle to home ownership the fresh down payment. But which could feature the fresh new tradeoff away from a top monthly fee. And therefore might be a significant difficulty, especially if it will make a huge impact on the amount of money you can cut immediately following your monthly obligations are repaid. You are not alone. Consult your economic properties provider for great tips on your targets as you budget for one new home.

This new USAA Information Cardio brings general pointers, equipment and you may resources to aid their $255 payday loans online same day Pennsylvania travels. Content get talk about factors, have otherwise characteristics that USAA Federal Offers Financial doesn’t bring. Every piece of information contained emerges having educational motives merely which can be maybe not intended to depict people endorsement, conveyed or implied, by USAA or any affiliates. Most of the suggestions given is actually subject to change without warning.