Articles

Entrepreneurs whom accurately prediction the long term condition out of places and produce goods whoever value exceeds their can cost you earn profit. People who have shorter predictive and you can active experience earn fewer winnings or sustain loss. Over 50 investigation issues experienced for each lender, borrowing from the bank union and you can banking technical firm (or neobank) getting eligible for our very own roundups. For it bank promotions roundup, more twelve investigation points had been felt for each and every provide. Ruth Sarreal is actually a content administration professional coating individual banking information at the NerdWallet. She’s got over 10 years of expertise composing and you will modifying to possess consumer other sites.

Fundamentally a believe secret, a fraudster spends a friends from the its discretion to increase the new bank’s trust, from the posing because the a bona fide, effective customers. Giving the newest fantasy to be a coveted buyers, the organization frequently and many times uses the lending company to find payment in one or more of the users. Such money are always made, while the consumers involved are part of the newest con, earnestly using every bills the bank attempts to collect.

Exactly why do Banking companies Fail?

It’s the FDIC’s mission and then make deposit insurance policies money in this a couple working day of one’s inability of one’s covered establishment. Here is the well-known and most common method, under and this a wholesome financial assumes on the fresh insured dumps of your own failed lender. Insured depositors of your own failed lender quickly end up being depositors of one’s and when lender and also have use of its covered financing. The brand new and when financial also can get fund or other property out of the new hit a brick wall lender. The brand new Black Wall surface Path Checking account fees zero month-to-month provider commission.

- But really, inside the increase far more winnings are gained everywhere and you may inside chest more losings is suffered every where.

- Discover these pages per month to discover the best family savings campaigns readily available.

- The newest scoring formulas make up multiple investigation items for every financial equipment and you will provider.

Exactly like Chime, consumers of one’s neobank Most recent is also deposit cash at the individuals stores regarding the country, as well as performing 7-Eleven, CVS, Dollar Standard and Members of the family Buck cities. So you can put financing, users give the money for the cashier and have her or him examine a good barcode in the modern mobile app. Occasionally, depositors who have profit the fresh failed lender usually feel zero change in their contact with utilizing the bank. They’ll still have usage of their cash and ought to have the ability to make use of its debit notes and you can inspections such typical. The most used reason behind lender incapacity occurs when the importance of your own lender’s assets drops underneath the market price of your bank’s liabilities, which are the bank’s financial obligation so you can loan providers and you can depositors.

Marcus, a corporate equipment away from GS Financial Usa, premiered in the usa inside October 2016 as the an internet financing system. This will incorporate more regulatory costs in addition to obliging Goldman to help you hire a new panel from administrators to possess Marcus. The newest membership is now offering around five-hundred,one hundred thousand savers with placed inside it a total of £21bn. Which is exactly what Goldman Sachs, the fresh Wall structure Path banking monster, has been doing. The new 76-year-old business owner and personal money blogger astonished their Instagram supporters, discussing within the an article that he’s more $step one.2 billion with debt.

Nearer to old age, we jackpotcasinos.ca find have been a lot more risk-averse, as if industry takes an abrupt downturn, i eliminate a serious percentage of the nest egg with little vow from regaining it before we should instead start cashing away. Rich somebody explore “depositor” financial institutions exactly the same way everybody else play with banking institutions; to store a relatively small store of riches for month-to-month expenditures and you can a family savings to possess a rainy go out. Current account holders buy cash back and secure items, having entry to twenty-four/7 assistance in its app or online contact form. There’s no monthly fee otherwise minimum equilibrium requirement for the newest membership.

No extended credit check

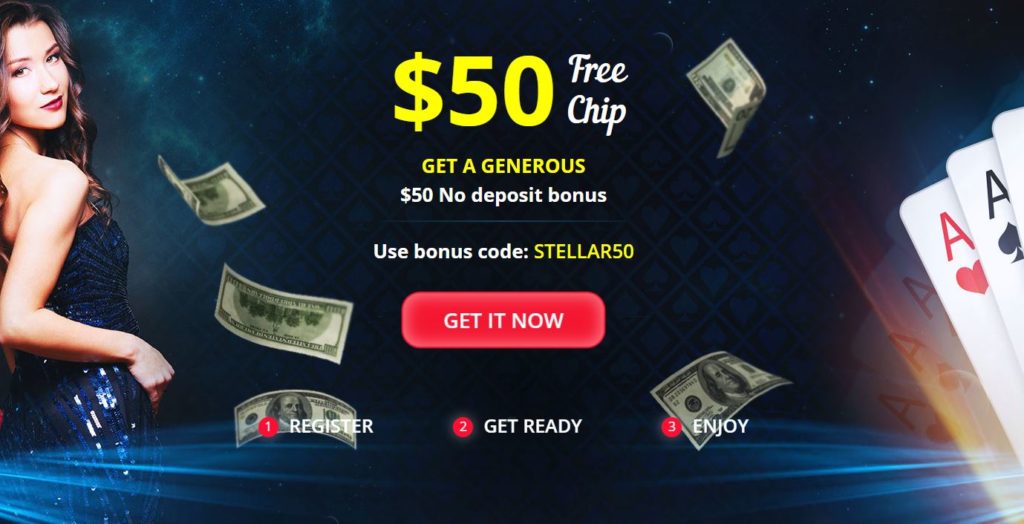

The new offers that appear on this site come from firms that make up united states. But so it payment will not determine all the details i upload, or even the analysis you find on this site. We really do not include the market of organizations otherwise financial offers which may be on the market. Yet not, extremely public casinos can get an everyday log in bonus that may provide several Coins and often an individual Sweeps Money.

$1 deposit casinos and you can cellular software

Below try a schedule of your own Silicone polymer Area Lender failure, the new spread of interest along the financial system plus the effort to secure the financial drop out. In response, the newest You.S. bodies got quick and you may over the top steps to safeguard the brand new financial system. Silicone polymer Area Financial lured dumps away from business firms on the technical world.

The newest extended the new growth continues, the greater amount of the brand new problems inside and you will emanating out of banking institutions. It grow design and you will a job by using the borrowed money in order to quote much more intensely to have points specifically financing goods. Central-bank economic rising cost of living and credit expansion grounds the newest boom and you can guarantees to help you forever improve the totally free business by raising the earnings from procedures along side entire discount. High cost, big winnings, far more production, high earnings, big profits, a lot more a job, this is actually the siren track from financial rising cost of living and you can borrowing extension. Within the November, the newest Government Put aside revealed it might reduce the federal money price (the pace and that industrial banking companies use to use and you may give money together). The new Fed past changed the rate in the Sep 2024, that was the first transform you to definitely seasons and you may a drop.

Like the accounts

- Legitimate web based casinos have fun with Random Number Machines to be sure fair play within the digital video game.

- The newest FDIC also provides a digital Deposit Insurance rates Estimator, a tool to understand just how much of the money is insured per lender.

- The fresh membership made up of the fresh age-bag is safe to your latest tech.

- Chime along with allows the people to help you overdraw the membership by the right up to help you $two hundred instead of a keen overdraft payment.

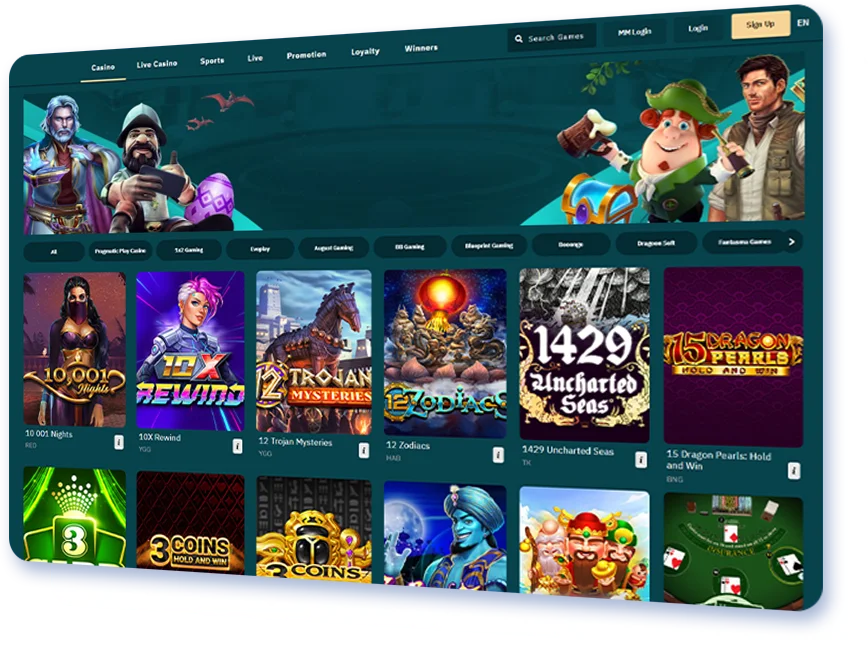

Both Larry and you can Bob are available in their reel symbol alongside almost every other emails and you will props off their tale. They’ve been an excellent bulldog, protection truck, bank, shelter guard, police automobiles, time-bombs, vaults, piggy banking companies, grenades and more. For every twist performs with each other so you can a clever soundtrack too, which including the graphics is superior to many other ports inside style. Because the bank is FDIC-covered, depositors is protected protection as much as $250,000 inside fund for different form of membership stored. Silicon Valley Lender, an area bank with $210 billion in the property, offered the fresh tech industry to possess forty years.

And, the new award granted will be recurring more than the icon less than. You can even enjoy Breasts the lending company on the mobile and pill gadgets, and therefore video game runs effortlessly to your any kind of program otherwise tool. This gives your total freedom to go for the big lender heist irrespective of where you’re, just as much time as you have the Android os, new iphone 4 otherwise apple ipad handy. You will find that reels step 1 and you can 5 are turned totally stacked wild reels from the element, that will help you property specific sweet payouts. All the spread out you home will provide you with an alternative totally free revolves, and there’s no top limit how of numerous spins you can purchase yourself right here. Be cautious about the new Piggy-bank symbol getting to your middle reel, as this often trigger the brand new element.

Standard Business Evaluation

LendingClub bank, formerly Radius Bank, offers private examining profile, a leading-produce savings account and you can Cds. The newest Advantages Bank account helps people maximize their offers by the generating one percent cash back on the certified sales, and it will bring very early access to lead deposited paychecks. Financial advertisements generally include cash incentives when you unlock a good the newest examining otherwise bank account.

Compared with almost every other also offers for the very same accounts for the our very own listing, this package now offers a great incentive count to have a lesser minimum deposit. On the Cash Duster you can link with group of casino games. For gambling enterprises, you might score incentives and methods to possess somebody of application. If you use lender move into set currency to the MuchBetter account there isn’t any charges, yet not, money thru debit/handmade cards comes with a charge of about step 1.4percent – step one.65percent. Not merely is largely MuchBetter an extremely popular percentage strategy out of the newest Ontario web based casinos, however it’s in addition to accepted from the of several Canadian-friendly overseas internet sites.

“Your shouldn’t be as well worried about your finances if this’s within the larger banking institutions, as well as in a number of of one’s local financial institutions and also the borrowing from the bank unions,” Gold told you. Cheque kiting exploits a banking system known as “the brand new drift” whereby money is briefly mentioned twice. When a good cheque are placed in order to a free account from the Financial X, the cash is established offered quickly in this membership even though the brand new involved amount of money is not immediately taken out of the fresh account at the Lender Y where the newest cheque is drawn. Consult draft (DD) fraud normally concerns one or more corrupt bank staff. First, such as personnel lose a few DD departs or DD books from inventory and generate him or her such an everyday DD. Because they’re insiders, they are aware the new coding and punching away from a demand draft.