https://paydayloancolorado.net/yampa/

If you find yourself considering taking advantage of all the way down rates of interest or an altered loan identity with a home loan re-finance, you may be questioning how long the procedure requires.

The procedure of mortgage refinancing differ based on resident and you may financial info. A great refinance with Get a hold of Lenders usually loans within the an average of 6-2 months. That time stops working in this way:

- Getting the maxims (doing step 1-two weeks). Implement online or higher the phone to examine the loan choice, then publish required records. We are going to confirm the initially eligibility.

- Operating their information (up to four weeks). We are going to collect 3rd-team information regarding your home right after which send your complete app to underwriting to have a final decision.

- Closure you loan (doing step 1-two weeks). We’re going to contact you to plan the closing immediately after which arrange for the loan finance to get provided for your profile.

Do you know the grade out-of refinancing?

Out-of app to help you closing, the time it entails so you’re able to re-finance a house will vary established in your novel disease together with bank you choose. Here you will find the actions employed in getting a home loan re-finance:

Application

When you sign up for an effective refinance, the application form often is done on line or over the phone within just minutes. Doing your application as fast as possible, rating waiting before you start by the collecting important information you will must provide to a loan provider.

- Spend stubs

- Tax versions (W-2s, 1099s)

- Bank comments

- Investment guidance (investments)

- Homeowners insurance

- Name insurance coverage

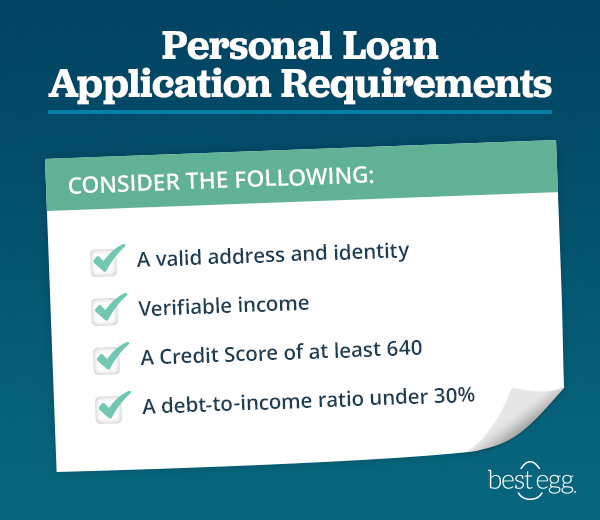

It’s also advisable to check your credit score to see if your meet the lender’s criteria. Your credit rating is employed because of the loan providers to help them determine exactly how likely youre while making your monthly payments timely. A high credit rating can lead to a much better speed.

If the newest credit rating will not see your lender’s minimal standards to have refinancing, working to improve your get can also be enhance the probability of approval if you find yourself generating one particular aggressive interest rates.

Its smart to acquaint yourself which have prominent home loan terms before applying you will be ready to answer one inquiries on the financial.

Approval decision

How fast you’re accepted depends upon once you publish your paperwork. Of many loan providers will allow you to properly upload data on line to let automate the option.

If you are looking for home financing re-finance, make sure to view a beneficial lender’s lowest eligibility conditions ahead of applying. This is exactly an easy way to evaluate whether a certain financial does approve the job or not.

But not, the only method to understand certainly will be to over the application and gives each one of files that make certain your own eligibility asked by lender.

Rate secure

If you find yourself refinancing so you’re able to secure a lesser interest rate, consider mortgage secure as part of your application procedure. A speed secure claims an increase getting a flat age of time, typically out of software in order to closure.

Underwriting

The latest underwriting procedure can take between a few days to more than a week. Underwriting occurs when the lender determines once they must offer you a loan predicated on their paperwork. They test your credit history and your private, economic, and you will financial data files to choose for many who see the requirements. You could let ensure this course of action movements as fast as possible insurance firms all your valuable paperwork completed along with buy.

Home appraisal

The appraisal several months begins in the event the appraiser check outs your property and comes to an end after they deliver the statement. So it usually takes anywhere between seven and you will ten weeks. Appraisals usually takes expanded if you’re for the a secluded city, have a more cutting-edge house, or if perhaps the brand new appraiser is specially busy.

Closing

Closing is the final step-in the latest refinance techniques in which you signal every files and you may spend your own closing costs. In some cases, a lender wouldn’t need you to spend any closing costs. When comparing lenders for your refinance, be sure to examine every financing enjoys they offer this may save some costs during the total charge for the their financing.

Delays throughout the a mortgage re-finance

With regards to a few affairs that can slow down an effective home loan re-finance, most are in your control although some aren’t.

Simple tips to plan a home loan refinance

Out-of application to help you closure, the full time it will require to help you re-finance property may differ by the resident. Refinancing having Select Lenders generally fund for the normally 6-two months. Examining to find out if you meet your lender’s official certification, getting your records ready, and planning your house to possess appraisal might help flow the procedure with each other as fast as possible.

Find offers products and you can tips to help you decide what performs right for you. Play with all of our mortgage re-finance calculator before you apply to determine in the event the an excellent refinance helps you satisfy your financial desires.