Home loan borrowing certification (MCC)

A home loan borrowing from the bank certification has the benefit of earliest-big date residents and you can veterans a federal tax credit for a percentage away from annual mortgage attract payments. When you’re have a tendency to in conjunction with sort of earliest-time consumer finance regarding particular county apps, this new certification means only fulfilling earnings thresholds and you may maximum home values. Experts and you may inexperienced people will get discovered income tax save whether deciding having a conventional, government-backed, otherwise option financial choice.

FHA Finance

FHA fund are good in case the credit history isn’t really greatest-notch or their offers are restricted. Getting consumers with little to no fund having a down payment, FHA funds bring an inexpensive solution, and this only needs 3.5 % off and it has at least credit rating 580.

Va Financing

In the event you offered, Va finance offer a tempting possibility to buy property 100 % free away from downpayment obligations. This is why Virtual assistant financial work for, no upfront money is necessary for army people and pros.

USDA Funds

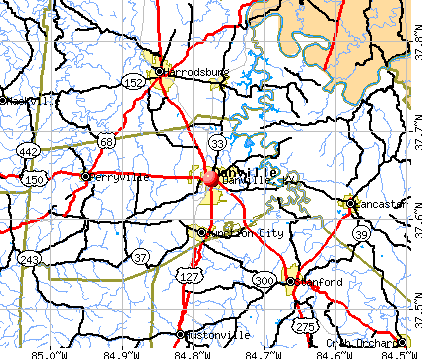

A down payment is actually optional to have prospective homeowners focusing on rural characteristics under the USDA loan system. Available portion can be minimal, however, creditworthiness is key-millions of 640 or more promote qualifications.

Good-neighbor Across the street system

Certain specified areas present the newest doubled benefit of casual down-payment minimums and also the added bonus regarding belongings discount 50 % off of the listing price. Coupons abound under this unique HUD system of these capable qualify by the place.

Inclusion off an application on this website does not compose a keen affirmation by the Full Financial and won’t verify your eligibility otherwise recognition into the program.

Home loan costs is volatile and you will susceptible to transform without notice. All of the prices shown is actually to have 29-date speed hair which have two and a half situations to own an effective solitary family relations holder-filled primary home which have 750 or more FICO and you can 80 LTV more a 30-12 months mortgage name except where or even noted and tend to be subject to mortgage recognition having full files cash. The Annual percentage rate to have a 30-season and 15-seasons antique repaired-speed mortgage loans was calculated using a loan amount out-of $360,000, two and a half affairs, an effective $495 app payment, $450 assessment commission, $1,195 underwriting fee, a good $ten flooding qualification commission, and you will a great $82 credit file fee.* 15-year old-fashioned home loan costs was calculated with an effective fifteen-year financing name.* The fresh new Annual percentage rate to have jumbo financial cost try computed using that loan level of $five-hundred,000, two-and-a-half issues, an effective $495 software commission, $450 appraisal payment, $step one,195 underwriting fee, $ten flooding degree payment, and you will a beneficial $82 credit file percentage.* The fresh Annual percentage rate having FHA mortgage prices is actually determined using that loan amount of $360,000, two-and-a-half circumstances, an excellent $495 software percentage, $450 assessment commission, $1,195 underwriting commission, $ten flood certification fee, and a $82 credit history payment. Specific cost and you can charges can differ from the state.* The fresh new Apr to own adjustable rates mortgage loans (ARMs) is calculated having fun with a loan amount from $360,000, two-and-a-half activities, an excellent $495 app commission, $450 assessment fee, $1,195 underwriting payment, $10 flooding degree payment and you may an effective $82 credit history payment. Particular cost and you may fees can vary because of the condition. Items are at the mercy of access towards your state-by-county foundation. By the refinancing your existing financing, the overall money costs could be higher along the longevity of the mortgage.

Newbie homeowners in the Austin might be eligible for to $40,000 to help with closing costs in addition to their first money installment loans for the state of LA through a beneficial forgivable mortgage in the town itself. To help you be considered, your earnings have to be under $65,450 if you are alone, the newest threshold increases prior to members of the family dimensions, while the residence should be inside municipal restrictions. As well, the purchase price should be at most $614,.