Matt are a certified Monetary Coordinator and you will resource advisor situated in Columbia, Sc. He writes individual fund and you may money advice for New Ascent and you can their moms and dad team New Motley Deceive, along with cuatro,500 authored articles and a beneficial 2017 SABEW Best in Company award. Matt produces a regular instant same day payday loans online Alaska financial support line (“Query a fool”) that’s syndicated during the Usa Today, and his awesome really works could have been frequently searched for the CNBC, Fox Providers, MSN Money, and many other major outlets. He is a scholar of University of Sc and you may Nova Southeastern School, and keeps a scholar certificate for the economic think off Florida County School.

Do you have a USDA real estate loan? And generally are interest rates significantly lower than after you bought your domestic? If so, a good USDA re-finance will save you a large amount of money. In this article, we will talk about how exactly to re-finance an effective USDA mortgage. We shall plus talk about the different types of refinancing finance which can be offered plus certification standards to remember just before your incorporate.

Are you willing to refinance a great USDA home loan?

Sure. You’ll find nothing that states you ought to keep the completely new USDA financing permanently. It may be a great idea to help you refinance to take advantage regarding down rates of interest. You could also be capable of getting rid of mortgage insurance policies.

Although not, there can be quite a bit significantly more with the tale. For 1, you could re-finance a great USDA financing that have a new USDA mortgage, otherwise change it which have a traditional (not regulators-backed) financing. You can do what exactly is entitled a speeds-and-name re-finance to reduce their interest rate otherwise reset your loan title. Otherwise, you might want to capture cash out of the property whenever you re-finance. For additional info on refinancing as a whole, here are a few our total refinancing book.

Ideas on how to re-finance an effective USDA financial

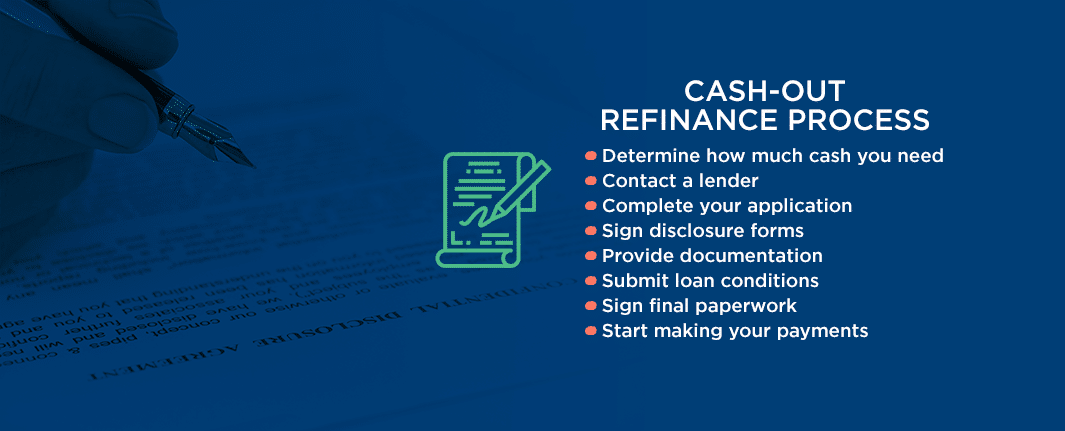

So you’re able to re-finance good USDA loan, you will have to speed store with loan providers, try using an educated refinancing option, immediately after which initiate the application form procedure.

Choose the best financial

All of our a number of an informed USDA mortgage lenders is a great initial step. But never maximum yourself to merely USDA financing. Almost every other loan providers may additionally has possess that attract. For example, you may such as lenders that have a huge branch network. Or even you are searching for finest-notch customer care scores and you can a virtually all-online software techniques.

Connect with several lenders and for a few style of funds

After you have simplified your quest to some great lenders, apply to each of them to see exactly what rates and you can financing terms you get provided. Additionally it is best if you evaluate your USDA refinancing selection that have conventional mortgages.

Choose which is the greatest refinancing option for you

Different loan providers offer additional rates. They likewise have various other settlement costs and may even present different types of financing. After you’ve used and you can seen your specific loan also offers, the next thing is to determine the best option for you.

Pertain and you will fill in the required documentation

After you have selected an educated refinancing option for their USDA loan, you’ll need to formally pertain. Depending on the kind of mortgage you submit an application for, it will be a good idea to get income paperwork handy. Next, merely stick to the lender’s recommendations and over your refinancing.

Most readily useful Lending company

It is critical to envision numerous mortgage brokers locate an excellent fit for your. We now have listed a favorite loan providers lower than so you can examine your options:

The recommendations are based on a 5 star measure. 5 a-listers means Best. 4 a-listers translates to Expert. step 3 celebrities translates to A great. 2 famous people means Fair. step 1 superstar translates to Poor. We want your money to operate more complicated for you. That’s the reason the analysis is biased on also provides that submit versatility while you are reducing-of-pouch can cost you. = Most readily useful = Expert = A great = Fair = Bad