Whether you pay your team through direct deposit, paper checks or pay cards, ADP will provide you with the tools to help generate an accurate pay statement. Employers face a number of potential compliance risks as they navigate pay statement disclosure requirements on a state-by-state basis. These risks include government audits, litigation, penalties, and potential reputational harm.

Financial Services

Choose medical, dental, and vision plans with no-hassle enrollment for you and your team. Get unlimited pay runs per month, make no commitment, and cancel anytime. Answer a few short questions, and we’ll recommend the right services for your business.

Payroll services for 1-49 employees

Netspend, a Global Payments company, is a registered agent of Republic Bank & Trust Company. Use of the Card Account is subject to activation, ID verification and funds availability. Transaction fees, terms, and conditions apply to the use and reloading of the Card Account. When looking for the best payroll software for your needs, see why others choose our blend of innovative technology and support to help them manage their payroll, HR, benefits, and more. Payroll for each employee is calculated according to whether they work on an hourly rate or are salaried. You will also need to factor in any overtime payments or bonuses.

Can I Do Payroll Online?

Failure to do so could be costly to employers, who could find themselves on the wrong end of a class action lawsuit. ADP automatically syncs with many popular accounting software products, including QuickBooks™, QuickBooks™ Online, Xero™ and Wave, to ensure a seamless transition of your data. Check with a payroll provider to make sure they pair up with your preferred program.

For example, maybe you have only a handful of employees now but want to grow in the future and will need more bells and whistles. The TriNet mobile app offers convenient features for both employers and their employees. Employers and permissioned personnel can 36 synonyms of auditing view employee profiles, hire and termination data, benefits and payroll information and access reporting. They can also search a knowledge base for answers to their questions or open a support case or live chat session to access TriNet customer support.

It’s stripped down for businesses that just need easy payroll, with flexibility to add on services as you grow. Employees can then use a left-hand menu to find more detailed information, such as their health benefits options and performance reviews. Simple forms and digital signing tools allow employees to complete documents and reviews in a fully digital format, even on a small screen. Choosing a payroll system is critical for setting up payroll, because it’s the method that will guide your process each pay period.

Square Payroll for Contractors will generate, prepare, and file Form 1099-NEC online for you. Add HR Experts to your Payroll subscription to get advice, tailored to your business, from certified HR professionals. Jeff is a writer, founder, and small business expert that focuses on educating founders on the ins and outs of running their business. From answering your legal questions to providing the right software for your unique situation, he brings his knowledge and diverse background to help answer the questions you have about small business operations. With QuickBooks Payroll Premium, you’ll transfer your own data but we’ll review to make sure everything is correct. We will help you transfer any existing payroll information to QuickBooks.

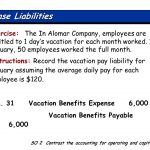

We use product data, first-person testing, strategic methodologies and expert insights to inform all of our content so we can guide you in making the best decisions for your business journey. These are wages paid for hours worked above the 40-hour work week. Notate on the spreadsheet the total gross wages and overtime wages earned for each employee. Before you can think about deductions, you need to calculate gross pay. Multiply the number of hours worked by the hourly wage you pay them.

- It boasts a score of 4.5 from 1,900 reviews on G2 and a score of 4.7 from over 3,800 reviews on Capterra.

- That means, in addition to automated payroll, you’ll receive full-service features.

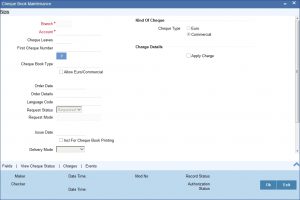

- Right now, check that it’s within your budget and is compatible with your point-of-sale and/or payroll software, as well as your accountant’s system.

- I could also use filters to group data by department or pay type, for example.

Most payroll services also include benefits administration, so you can use the platform to set up paid time off, retirement plans, insurance and other benefits for employees and integrate benefits with payroll. Some payroll services offer automated payroll, so you can set worker pay and employees can track their time (if necessary) and the service runs payroll on schedule. The services let workers enter direct deposit information, and you connect a business bank account on the employer end, so payroll runs without you having to print and deliver checks. Although each has a unique design with varied features, most online payroll services work basically the same way.

I tested Gusto’s Simple plan features using the Google Chrome browser on a Windows laptop and the Gusto Wallet app on an Android mobile device. Our ability to test the features was limited, as they required entering real bank account information and signing into external accounts. Technically, a manual payroll is done by hand with calculations performed on paper. With the use of computers, most people consider manual payroll as any payroll you process without the help of a payroll processing provider. For all other deductions, determine how much needs to be pulled from the gross wages and where it needs to be sent, such as health insurance provider. Always factor in what you pay as an employer as a separate line item than what comes out of the employee’s gross pay.

It includes everything from pen-and-paper records to using an Excel spreadsheet template . HR, benefits, and accounting solutions that automatically sync with your payroll. Easily run payroll, pay taxes, and stay ahead of compliance so you can focus on running your business. Quick setup means employees can start saving for retirement right away. Attract top talent and match contributions so employees can grow with you. Guideline experts handle 401(k) administration, compliance, and recordkeeping, at no extra cost.

Customizing the dashboard and viewing employee benefits was easy, while payroll and onboarding posed some challenges. I discuss my specific obstacles with payroll in the next section. https://www.business-accounting.net/arm-s-length-transaction/ A manual payroll system is cheaper than hiring a service provider to do the work for you. While it is less expensive, it does run the risk of errors in calculations and withholdings.

The features available in the package you choose will ultimately determine your total work effort. Businesses that opt for full-service payroll may also receive professional assistance with regulatory compliance and have taxes filed on their behalf. More than half of small firms with five or more employees pay an outside firm to prepare their payroll, according to the National Small Business Association1. Discover https://www.quickbooks-payroll.org/ how ADP’s payroll software can help you improve your business operations. 2 Paychex Promise will be offered free of charge to business owners for the first three months of service, and thereafter will be offered as a complete suite of services for a fixed, all-inclusive fee. Program and/or any of the services offered as part of Program are subject to eligibility and are void where restricted by law.

However, unlike many competitors on this list, only the most expensive plan offers payroll features. To access payroll features in the first two tiers, you have to first purchase the core plan and then pay $6 per employee per month more to access the payroll add-on. When I contacted customer support, I was told that this payroll add-on is typically only sold as an add-on and not as a standalone product. They do all the heavy lifting with taxes and withholdings for a small fee.