They serve small businesses but they themselves are small businesses,” von Schirmeister says. Collaborate with your peers, support your clients and boost your practice. Our app library is home to a range of tools that help you with onboarding, invoicing, approvals, reporting, and payroll. Adding a single app at a time to your technology stack will also help with staff training.

How to track business expenses

This nuanced understanding underscores the importance of tailored support and resources to meet the varied requirements of different businesses. This approach ensures that the benefits of Xero’s innovations are effectively communicated and utilised by the end users—small business owners. Offering grants, low-interest loans, and comprehensive workforce development programs can help small businesses adopt new technologies and upskill workers. Streamlining regulatory processes and providing tax incentives can spur innovation. Improving transport infrastructure and digital connectivity can bridge regional gaps, facilitating smoother business operations and market access.

Subscribe to get your daily business insights

Kristy Snyder is a freelance writer and editor with 12 years of experience, currently contributing to the Forbes Advisor Small Business vertical. She uses her experience managing her own successful small business to write articles about software, small business tools, loans, credit cards https://www.kelleysbookkeeping.com/profit-and-loss-statement-template/ and online banking. Kristy’s work also appears in Newsweek and Fortune, focusing on personal finance. Both FreshBooks and Xero are cheaper than QuickBooks while offering many of the same functionalities. QuickBooks has more inventory management and budgeting tools than FreshBooks.

How FreshBooks and Xero Stack Up

Because if you think about those three jobs we talk about – core accounting, payments and payroll – they’re massive at Xero. We call them super jobs because inside of them there are so many other jobs. [for example, core accounting might contain tax, analytics, pre-accounting etc]. Additionally, enforcing strict payment terms and strengthening the Prompt Payment Code can improve cash flow and financial stability. Finally, encouraging digital skills training and the adoption of AI and automation can further enhance efficiency and productivity for small businesses.

JAX, your smart business companion, available in beta in August this year, will help you and your clients run your businesses more efficiently. You’ll be able to Just Ask Xero to complete tasks such as generating an invoice or editing a quote right from the apps and devices you commonly use. Being a cloud-based service Xero naturally works just as long as you are connected to the internet and use any one of the popular web browsers out there. You’ll find that Xero is similarly sprightly if you choose to use its app-based editions, which are available for both iOS and Android devices.

FreshBooks vs. Xero: At a Glance

It’s not about having as many apps as possible – it’s about cleverly curating your stack. For example, approvals software automatically sends invoices to the right approver before they’re sent. Stack this approvals software with a digital payments tool, and you could shorten the time between sending an invoice and https://www.online-accounting.net/ receiving the money. Xero looks to be shaking up its pricing structure and strategy in the coming months. Currently, if you’re looking to sign up with the service in the US then the Early plan costs $11 per month. This gets you 5 invoices and quotes, lets you enter 5 bills and reconcile 20 bank transactions.

Now, you can build a system that involves multiple tools but feels like a single practice workflow. Xero is cloud-based accounting software that packs a real punch when it comes to features and functionality. Based in New Zealand, the multi-faceted package currently comes in three incarnations and is aimed at small, medium and larger-sized businesses.

We compared the two options in terms of their key features, pricing and customer service to help you decide which is right for your business. Xero, FreshBooks and QuickBooks all offer 30-day free trials and extensive features for online support, including a live chat, email support and a knowledge base. All three of these offer the ability to scale their accounting for larger businesses and both Xero and QuickBooks offer specific training for accountants. These companies offer Gusto integration for the same price—$40 per month and $6 per month per person.

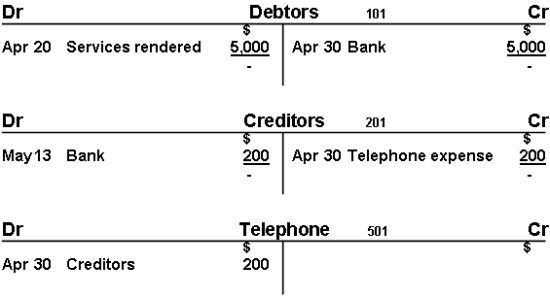

- This was traditionally done by writing them into a cashbook or punching them into a spreadsheet.

- Why you can trust TechRadar We spend hours testing every product or service we review, so you can be sure you’re buying the best.

- You’re able to send 20 quotes and invoices per month, enter five bills, reconcile bank transactions, capture bills and receipts with Hubdoc and view a short-term cash flow and business snapshot.

- Though they have different functionalities, both made our list of the best accounting software.

- Then, you can connect your bank accounts to Xero and decide if you’ll accept electronic payments for online invoices.

- While the delay to 2026 gives more time, it’s essential for businesses to start preparing now to ensure a smooth transition.

Often bank fees, interest payments, deposits, and payments that haven’t yet hit your bank accounts will need to be accounted for. Xero is an accounting software best suited to small businesses looking for high-level accounting systems. FreshBooks is better geared toward freelancers and very small businesses that need to send a lot of invoices to clients. Though they have different functionalities, both made our list of the best accounting software. These ratings are meant to provide clarity in the decision-making process, but what’s best for your business will depend on its size, growth trajectory and which features you need most.

Run things smoothly, keep tidy online bookkeeping records, and make compliance a breeze. She also flagged artificial intelligence’s significant impact on Xero’s products, with machine learning powering OCR scanning, bank reconciliation and cashflow predictions. “There was a very good and warm reception to a lot of the product announcements we made,” Alex noted. Key highlights included advancements in core accounting, payroll, payments, and the integration of artificial intelligence (AI). Xero’s support for SMBs extends beyond product features, however.

Similarly, establishing local business hubs can foster innovation and provide essential support. Xero’s recent productivity report showed an urgent need for targeted government action to support and enhance productivity across small businesses in the UK. We’d recommend building your software stack one block (or tool) at a time. This will give you the best chance of integrating each new piece of software successfully. I’m excited about the developments we’ve made in GenAI over the last year, and we’re just getting started.

If necessary, you can also give a Xero support person access to your account so they can take a closer look. Xero doesn’t have a phone number customers can call, but it can provide a callback if necessary. You can enjoy project conversations, file sharing and project due dates, but these features are most helpful for individual or small-team projects. FreshBooks offers unlimited time-tracking in its lowest-tier Lite plan, whereas Xero users would have to opt into the highest-tier Established plan for that feature. Xero doesn’t provide a phone number on its customer support page, but a representative will call you if necessary. This is a serious drawback if you want to be able to pick up the phone and talk through an issue or are new to accounting software and have lots of questions.

Apps like Stripe, GoCardless, Vend, and Shopify connect seamlessly and sync data with Xero. Singh Cassidy also shared insights from her early experience with bookkeeping, ploughing through the books for her parents’ medical practice. For her, this hands-on experience, involving manual ledgers and late-night tax filings, underscored the transformative potential of technology such as Xero for small businesses. “We were over-invested as a company, so we pared back in order to give ourselves room,” said Singh Cassidy.

Focus on the challenges and opportunities in your practice, and your client needs. For example, if clients need help with cash flow forecasting or automating accounts payable, start there. This will be your hub; a core piece of accounting technology that links all other tools together. Having a central piece of software that offers most of the functionality your statement of account practices and clients need means you can focus on building a curated tech stack. Comparing FreshBooks and Xero side by side shows that their starting prices aren’t bad—though Xero is the cheaper option for both the introductory and regular offers. If you’re looking to pay bills regularly, it makes more sense to Xero, as you can pay five of them on the base plan.

However, the best option and price point will depend on the specific capabilities and features you are looking for. Get the most out of Xero with access to our team of onboarding specialists during your first 90 days.