An opposite home loan is a kind of home equity financing you to definitely enables you to convert area of the security of your property to your bucks without the need to sell your home or shell out additional monthly payments. Opposite mortgages are usually catered towards the elderly residents, but they also have feel a good old-age believed device getting many residents. These types of mortgage does not need to end up being paid down up to the fresh debtor dies, deal your house, otherwise permanently moves out. The newest Debtor have to maintain the family and you can shell out property taxes and you may homeowners insurance. You will find several kind of House Collateral Sales Mortgage loans (HECM), however the type of we advice is a kind of opposite home loan insured by the Us Department off Property & Urban Development’s Federal Homes Administration often called new FHA.

How can opposite mortgage loans performs?

In lieu of a timeless financial that individuals pay each month, an other financial can make money to borrowers. Individuals will get this type of payments in several ways: (1) a lump sum payment, (2) as the normal monthly premiums, (3) because a credit line, or (4) as the a combination of monthly premiums with a personal line of credit.

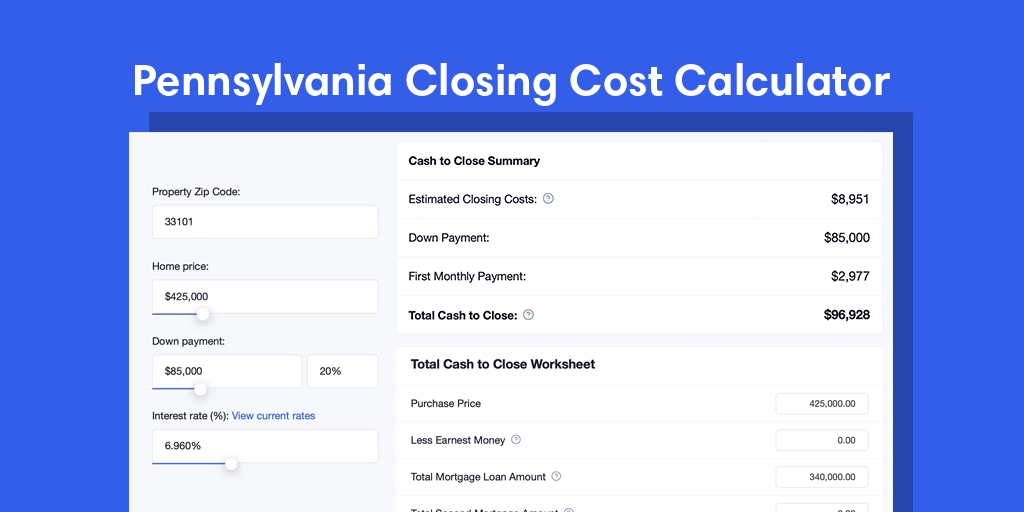

You will find some circumstances one determine the level of loans you is discovered regarding a reverse financial, such as your many years, property value domestic, and you can interest rate.

That would make use of a face-to-face financial?

- Is actually ages 62 and you will old whom own property otherwise provides short mortgages.

- Do not want to move.

- Are able to afford the expense of maintaining their house.

- Must supply brand new collateral in their home to supplement its earnings or has actually money readily available for a rainy go out.

What are the advantages of Opposite Mortgage?

- Does not require month-to-month mortgage repayments into the financing prominent and you can desire on debtor. The fresh consumers have to spend the money for home taxation and you may homeowner’s insurance rates and maintain the property within the good shape.

- Proceeds are often used to repay loans or settle unforeseen expenses.

- Fund can increase month-to-month cashflow.

The mortgage is designed to provide funds from the fresh new security out-of your home without any weight of mortgage costs.

The new Name remains in your label. The financial institution Cannot own your house. You will find a rely on Deed just as with virtually any real estate mortgage.

Even though you play with every currency your be eligible for, you could stay-in your property your whole lifetime.

The loan just comes owed, and really should be distributed away from, if you (otherwise your lady) dont take your house as your first residence. Brand new loan’s purpose it to incorporate property for the people you will ever have.

There aren’t any required month-to-month mortgage money. To take care of so it the interest number could be put in the borrowed funds number monthly therefore, the mortgage becomes a small bigger each month.

Needless to say, you need to afford the fees, insurance coverage, HOA if any, and for domestic fix, as with any mortgage.

Once you citation, our home visits their heirs. He has got the option to sell or contain the family of the paying off the borrowed funds, and they’ve got ample time and energy to choose. All leftover collateral along side financing harmony goes toward your own heirs.

All of the kept equity, the total amount over the mortgage, visits you, your own home, otherwise their heirs, not to the lending company.

Non-recourse loan If you have a great downturn from the a home ount, your or their heirs will not are obligated to pay the real difference.

Maybe not closed for the – https://paydayloanalabama.com/brookwood/ you could circulate, offer, otherwise pay-off the main balance any time no prepayment penalty.

Lynn is the inventor and you will broker-owner of your Industrial Financing Arranger, LLC, licensed of the State of Colorado, and is working under the joined change term of Age Set up Mortgage company. The company All over the country Home loan Licensing Program amount NMLS #1790945