It will also state that the auditor’s opinion is not modified in respect of this matter. When faced with such a requirement, candidates must be careful not to produce a list of generic audit procedures, but instead identify and highlight the factors from the scenario that may call into question the entity’s ability to continue as a going concern. Once these factors have been identified, candidates should then be able to think about the procedures the auditor may adopt to establish whether the factors mean the going concern basis of tax definition accounting is appropriate in the circumstances, or not. An entity prepares financial statements on a going concern basis when, under the going concern assumption, the entity is viewed as continuing in business for the foreseeable future. The term ‘foreseeable future’ is not defined within ISA 570, but IAS 1®, Presentation of Financial Statements deems the foreseeable future to be a period of at least 12 months from the end of the reporting period. Management may have a history of successful refinancing or carrying out other plans.

What is your current financial priority?

- It will also state that the auditor’s opinion is not modified in respect of this matter.

- This initial assessment is made without regard to management’s plans to alleviate going concern conditions.

- If the auditor receives a support letter, he can still request a written confirmation from the supporting parties.

- Auditors must be extra vigilant in relation to the audit of going concern matters, and should also remember the possible ethical implications of being involved in non-audit services relevant to going concern.

- The following are the key procedures that management should do to assess the going concern problems.

It follows that when this is not the case, a detailed analysis will be necessary, which likely includes robust cash flow forecasts and a review of existing and forthcoming financial obligations. The assessment typically requires significant judgment.COVID-19 impact on the assessment. The going-concern value of a company is typically much higher than its liquidation value because it includes intangible assets and customer loyalty as well as any potential for future returns.

Step 3 of 3

(Supporting party name) will, and has the ability to, fully support the operating, investing, and financing activities of (entity name) through at least one year and a day beyond [insert date] (the date the financial statements are issued or available for issuance, when applicable). The auditor should remain alert throughout the audit for conditions or events that raise substantial doubt. So, after the initial review of going concern issues in the planning stage, the auditor considers the impact of new information gained during the subsequent stages of the engagement. One of the most significant contributions that the going concern makes to GAAP is in the area of assets.

What is your risk tolerance?

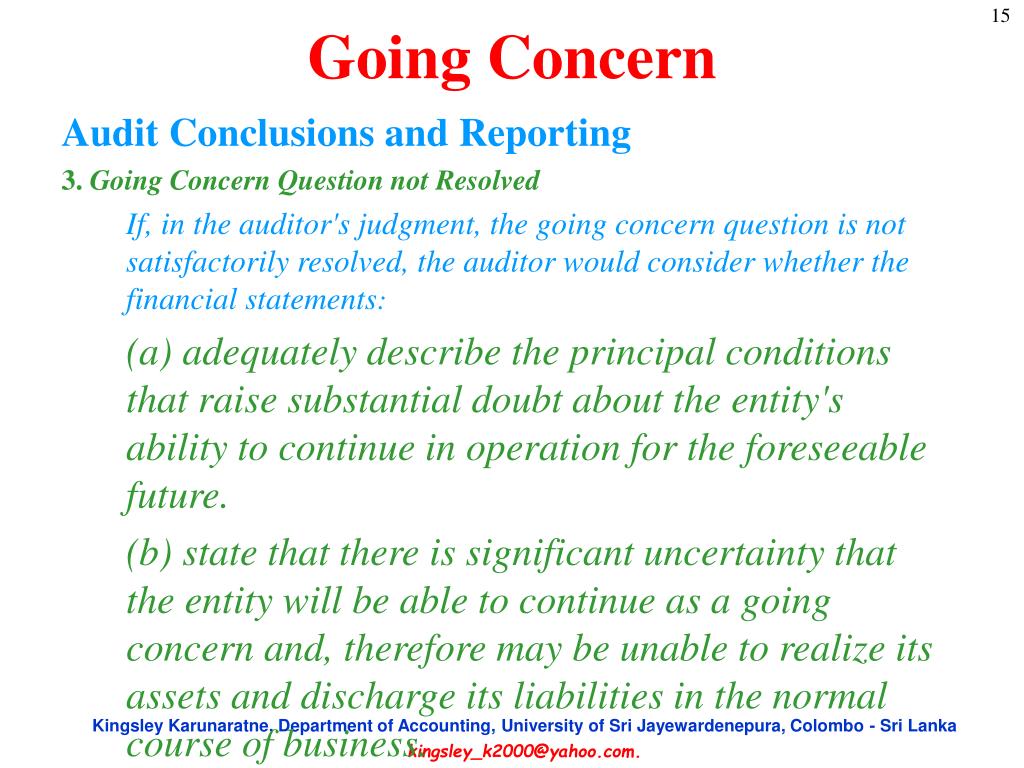

Paragraph A3 of ISA 570 provides good examples of financial, operational and other indicators which may individually or collectively cast significant doubt on the entity’s ability to carry on as a going concern. This is where the auditor’s judgement is critical as it is not conclusive that one or more of these items always signifies that a material uncertainty exists. The going concern concept is not clearly defined anywhere in generally accepted accounting principles, and so is subject to a considerable amount of interpretation regarding when an entity should report it. However, generally accepted auditing standards (GAAS) do instruct an auditor regarding the consideration of an entity’s ability to continue as a going concern.

A small business cannot make payments to its creditors due to an extremely poor liquidity position. The court grants the purchase price of liquidating the company upon the petition of one of the firm’s creditors. The National Company has fallen into serious financial problems and cannot cover its duties. Due to this, the federal government provides the company with a bailout package and also a guarantee to clear all its credit payments. A corollary to the going concern concept is the assumption that a business enterprise will not be liquidated within the foreseeable future. For this reason, for purposes of accounting, business enterprises are presumed to carry on their operations indefinitely until such time as they are in fact liquidated.

If for example, a company expects to miss a debt service payment in the coming year, then substantial doubt exists. This initial assessment is made without regard to management’s plans to alleviate going concern conditions. Are you preparing financial statements and wondering whether you need to include going concern disclosures? Or maybe you’re the auditor, and you’re wondering if a going concern paragraph should be added to the audit opinion.

Liquidating a going concern can give an investor a bad reputation among potential future takeover targets. Member firms of the KPMG network of independent firms are affiliated with KPMG International. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm. It is important for companies to consider not only traditional sources of financing but also other sources – e.g. supplier finance arrangements. The procedures are the key procedures and additional procedures might be required.

Under Step 1, management determines whether events and conditions raise substantial doubt about the company’s ability to continue as a going concern. If a company is not a going concern, that means there is risk the company may not survive the next 12 months. Management is required to disclose this fact and must provide the reasons why they may not be a going concern. Management must also identify the basis in which the financial statements are prepared and often disclose these financial reports with an audit report with a going concern opinion. It is important that management’s assessment considers different scenarios, including at least one severe but plausible downside scenario.

On the other hand, a company may be operating at a profit buts its long-term liabilities are coming due and not enough money is being made. The calculation of goodwill takes into account the fair value of the net assets acquired less any adjustments for purchase price, encumbrances or unusual conditions that will not affect the future operations. Under this concept, it is assumed that the business will operate for a long period of time. When a business is started, it is assumed that it will not be dissolved in the near future.

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. A copy of 11 Financial’s current written disclosure statement discussing 11 Financial’s business operations, services, and fees is available at the SEC’s investment adviser public information website – or from 11 Financial upon written request. Going concern value is a value that assumes the company will remain in business indefinitely and continue to be profitable. This differs from the value that would be realized if its assets were liquidated—the liquidation value—because an ongoing operation has the ability to continue to earn a profit, which contributes to its value. A company should always be considered a going concern unless there is a good reason to believe that it will be going out of business.

Similarly, US GAAP financial statements are prepared on a going concern basis unless liquidation is imminent. Disclosures are required if events and circumstances raise substantial doubt about the entity’s ability to continue as a going concern. Although the terminology varies slightly, both GAAPs share the same objective of informing users of the financial statements early about the company’s potential financial difficulties. External events – e.g. a natural disaster, geopolitical unrest, climate effects or inflationary pressures – may cause economic conditions to deteriorate significantly and create economic uncertainty for many companies.