Mention If the newest FHA Loan is actually recommended just before , you’re qualified to receive a reduced UFMIP regarding 0

I’m the author of the web log and have a premier-creating Financing Manager and Ceo regarding InstaMortgage Inc, the quickest-broadening mortgage company in the usa. All the suggestions is dependant on my personal exposure to permitting thousands from homeowners and you will homeowners. We have been a mortgage team and will help you with most of the their home loan needs. In lieu of to generate leads websites, we do not sell your information so you can numerous loan providers or third-team organizations.

In this post, let us evaluate FHA Improve financing pointers, advantages of providing such as for example an excellent. re-finance, newest FHA. improve cost, in addition to top loan providers to work with. having including an excellent re-finance.

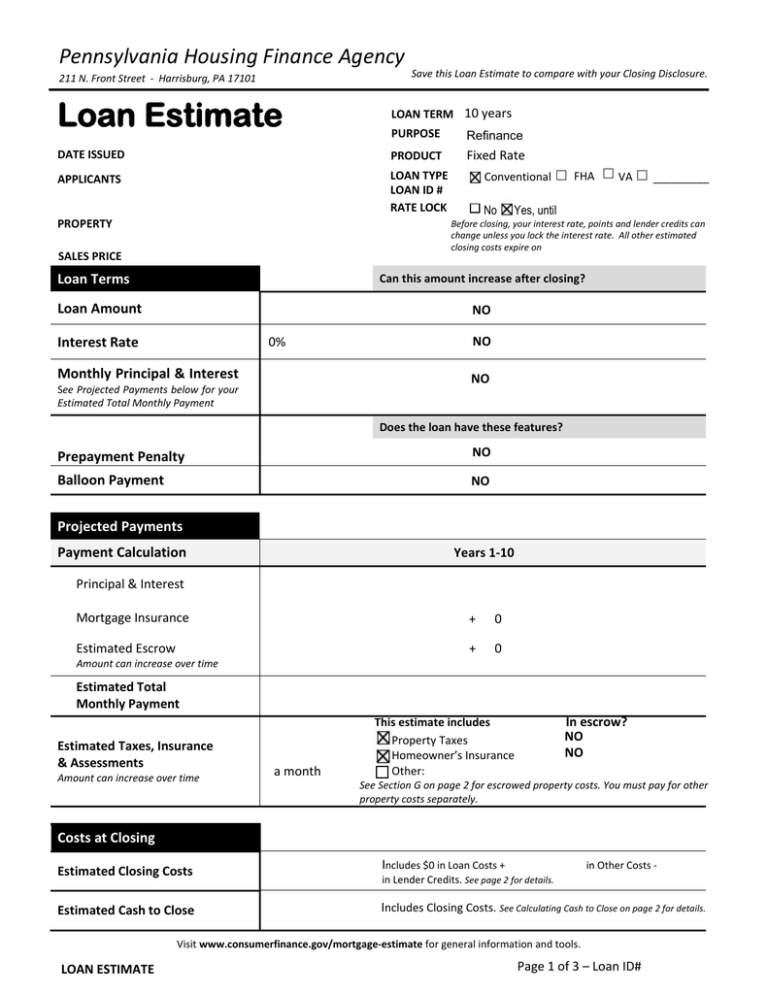

Refinancing out of a current FHA covered mortgage toward an alternative FHA insured mortgage is known as an enthusiastic FHA Improve Re-finance. The mortgage getting refinanced must be current (not unpaid). Not absolutely all FHA to FHA refinances was improve in nature.

Though FHA funds feature no pre-fee punishment, you need to watch for 211 days from your last FHA loan before you are eligible to have another type of FHA improve refinance.

One of the largest great things about an enthusiastic FHA Improve Refinance try you to definitely zero appraisals are needed. The loan-to-Value Ratio (LTV) are determined in line with the last appraised well worth after you got the current mortgage. Although not, no money-outs are allowed. In many cases, an appraisal may be needed.

On the best way to qualify for an FHA Streamline mortgage, new mortgage need fulfill a certain payment work for requisite otherwise you should be swinging of a supply (Variable Speed Financial) so you’re able to a predetermined Mortgage. Brand new desk less than shows the particular work for standards:

If you’re unable to meet up with the 5% work with specifications, you could potentially however re-finance regarding a keen FHA loan to some other FHA financing. You may still be eligible for a beneficial UFMIP refund (find less than), you would need to obtain the home appraised once again. Plus the the fresh Loan-to-Worthy of ratio would be calculated according to the brand new appraised worthy of, and this ratio can not meet or exceed %.

The fresh reimburse is actually a share of genuine UFMIP your paid down on the latest FHA financial. New payment goes down each month and ultimately will get no immediately following three years. The table lower than provides all the information:

The fresh new MIP (Home loan Insurance premium) for the an FHA Streamline (plus a frequent FHA loan) was away from two sorts Upfront Financial Cost (UFMIP) additionally the Annual Home loan Cost. The current UFMIP try step 1.75% for all financing. not, the newest Annual Home loan Top number will vary according to mortgage terms and conditions, loan amount, and you can LTV. This new dining table below info all the possible issues.

When you refinance off an enthusiastic FHA mortgage to another FHA mortgage within this three years, youre qualified to receive a limited UFMIP (Upfront Home loan Insurance rates) Hot Sulphur Springs loans companies refund

01% and you may an annual home loan premium out-of 0.55%. If you aren’t sure if your current loan is actually recommended prior to one time, contact us therefore are able to find you to definitely to you personally.

FHA Streamline Refinance typically has the same cost once the almost every other FHA programs, occasionally straight down. How to score an alive and most newest rates price is by doing this Speed Quotation Demand Setting.

Normal closing costs include Lender origination charge (Points) and you will Escrow/Title relevant expenditures and will add up to 3%-5% of your loan amount according to bank as well as the financing count. From the InstaMortgage, we perform render a no point and no closure prices option. Begin here with doing a type in less than a minute (No SSN expected).

You will also have to place-upwards another type of impound/escrow account and can need to built reserves currency to suit your Property Fees and you can Home insurance. But not, your current financial often refund you the escrow supplies harmony shortly after the brand new re-finance is actually finalized.

InstaMortgage was an approved FHA bank having excellent consumer studies into the Yahoo, Yelp, Myspace, and you will Zillow. Because of super lower prices, amazing customer support, and you will prize-effective expertise, our company is certain that we have been one of the recommended lenders to own for example a course. Email me to start off [email address protected]