- Sign on

- Shell out My personal Financing

- Purchase a home

- Financing Items

- Re-finance

- Home loan Calculator

- Professions

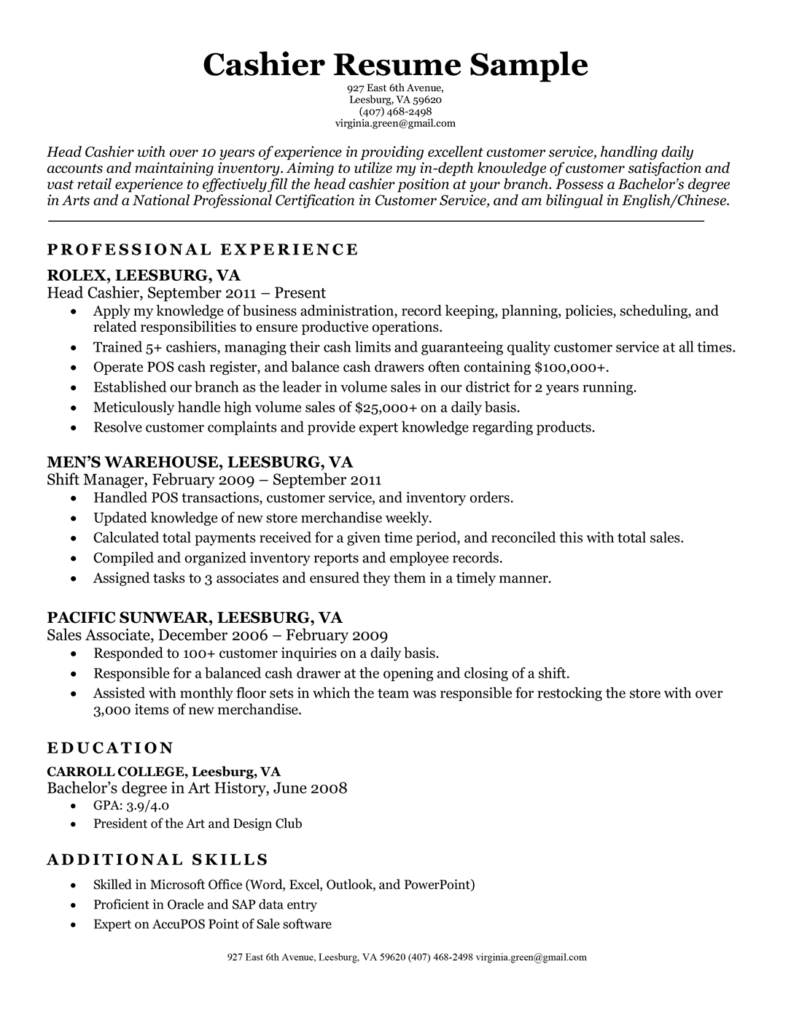

Mann Mortgage try proud so you can mention our very own “Hopes and dreams having Beams” program, which provides borrowers a better option for res. After you make use of good MannMade Renovation Loan, it is possible to access the collaborative, cloud-created repair loan application Washington loans no credit check to manage the entire enterprise away from begin to end whenever you are simplifying communications anywhere between you, the fresh builder, 3rd-class inspectors, and label businesses. We control your financing as well as the creator matchmaking into the-home, and you’ll run a faithful membership director throughout the renovation processes.

What are renovation financing?

A property restoration loan is a type of mortgage built to funds often a purchase or restoration of good fixer-higher household. In place of conventional mortgage loans, the recovery loan’s interest rate will be based upon the value of the house after renovation is done. This allows people to help you make use of its upcoming security to track down a reduced interest rate you’ll. Renovation financing could also be used so you’re able to refinance and you will remodel a great house the fresh borrower already has.

Restoration Finance Quick Evaluate

- Up to 100% financing for USDA and you will Virtual assistant

- Fund to 100% off household worthy of after finishing up work is done for (USDA and Virtual assistant finance)

Your Personalized Repair Loan Speed

203K financing are protected of the Federal Property Government (FHA) and so are have a tendency to used by family inside lowest- so you’re able to modest-income mounts to buy or refinance a first quarters in need from resolve. The amount of money are used for lowest fix performs such as incorporating a special room otherwise landscaping. It is also used in repair which is significantly more detailed particularly as plumbing work, kitchen remodeling, or usage of improvements if you have disabilities. Although not, something thought a luxurious isnt desired. Brand new FHA talks of luxury circumstances as the things like tennis courts, pools, scorching bathtub, and you will outdoor kitchen areas.

The advantage of an effective 203K family restoration financing ‘s the all the way down credit rating (640), down-payment (3.5% minimum), and you will financial obligation-to-earnings proportion (50%) than just the traditional HomeStyle financing make it. But not, you aren’t good 203K renovation loan will pay mortgage top (MIP). It is step 1.75% of one’s loan amount initial next 0.8% spread out inside monthly payments to the longevity of the borrowed funds.

Repair a classic household or get an aspiration house with an effective HomeStyle repair loan

HomeStyle loans is secured as a result of Fannie mae and now have a very restrictive credit history minimal (680), downpayment (5%), and personal debt-to-income proportion (45%) than simply a 203K. Although not, they have even more relaxed limitations toward sorts of home improvements you can do. Money can be used to renovate an initial, secondary, or money spent. And are often used to fund a wide range of renovation tactics, of repairs and you can improvement to help you swimming pools and you can outdoor kitchens. Consumers may use the money to change an old the home of its fresh fame or take an overlooked home and work out it their dream family.

Mortgage constraints are capped according to the town a house is located in. Understand the latest conforming mortgage limitations. There’s absolutely no initial MIP, however, instead 20% collateral from the refurbished domestic, a borrower would need to spend month-to-month MIP costs getting an excellent several months (otherwise up until they arrived at 20% household guarantee).

And therefore home loan option is good for you?

It can be tough to figure out which choice is ideal for you. Your credit score, amount of deposit, range of one’s investment, and you can last will set you back all of the need to be considered. If you have enough equity of your house, a funds-aside refinance could be preferrable so you’re able to property restoration loan. If you wish to buy good fixer-upper or if perhaps you want to help with your existing home, speak to your regional Mann Financial professional to go over every loan solutions to you.

We fool around with snacks to make certain that we supply the greatest, most associated feel including gauge the capabilities away from tricks and get to know website visitors. By pressing “Accept” on this banner, or that with the website, you agree to all of our Online privacy policy additionally the access to snacks unless you provides disabled them.